Government debt

In the space of five years, Spain's national borrowing has risen from 70% in 2011 to 100% of GDP in 2016 (OECD data below only available to 2015.)

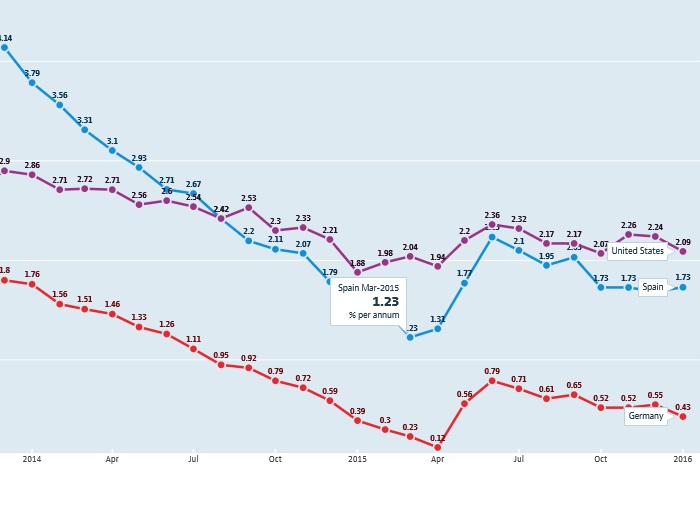

Interest rates (10 yr Government bonds)

Spain's peak spread relative to 10Y German Bunds and 10Y US Treasury bonds came in 2012 when the European Stability Mechanism led to the capitalisation of Spain's banking system. By Aug-14 Spain was trading below US 10Y bonds and by Jun-15 the Spanish risk premium had fallen to 153bps, despite volatility and contagion from Greece.

OECD (2016), Long-term interest rates (indicator). doi: 10.1787/662d712c-en

DECOUPLing from GREECE (2014-present)

Between Apr-11 and approx Nov-14, when Greece's risk premium has spiked Spain's has risen through contagion effects. After Nov-14 and with the recovery in the Spanish economy, a marked degree of decoupling can been seen between Greece's and Spain's risk premiums.

OECD (2016), Long-term interest rates (indicator). doi: 10.1787/662d712c-en

Household Debt

Spain's level of household debt fell from 141% to 128% of net disposable income from 2012 to 2014.

Household debt is defined as all liabilities that require payment or payments of interest or principal by household to the creditor at a date or dates in the future. Consequently, all debt instruments are liabilities, but some liabilities such as shares, equity and financial derivatives are not considered as debt.

OECD (2016), Household debt (indicator). doi: 10.1787/f03b6469-en